Outside the Home Cover

Items worth less than a specified amount individually such as watches, that you take outside the home, can be covered collectively by choosing a total amount of cover here.

Items you take outside your home are not covered automatically for loss, theft or damage under Contents Insurance. You must choose to take additional Possessions cover for them to be insured. Talk to us about your concerns and let’s see if we can get you covered, together.

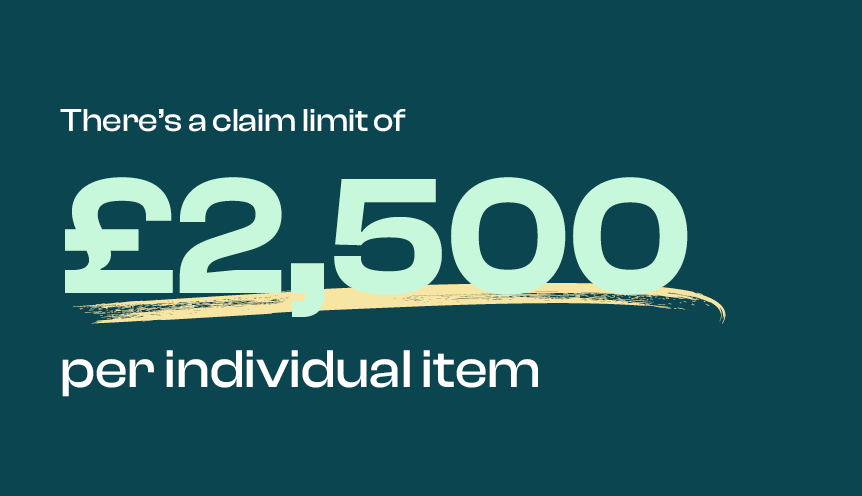

There is a claim limit of £2,500 per individual item except for phones where the claim limit is £500 and pedal cycles have a claim limit of £1000. Items worth more than these limits can be insured to a higher value but will need to be individually listed on the policy as specified items.

Items of high value

We can get these covered for you too!

Personal belongings individually valued over a specified amount need to be specified on your policy for them to be covered. High risk property also needs to be specified whether in or out of the home.

High-risk property means jewellery, precious stones, articles made from gold, silver and other precious metals, clocks, watches, furs, photographic equipment, binoculars, telescopes, musical instruments, collectors’ items, pictures and other works of art, rare and unusual figurines and ornaments, guns, collections of stamps, coins or medals. Furniture and curtains are not classed as high-risk property.

Personal belongings mean items worn, used or carried by you or your family in daily life (such as watches and jewellery), but not money, credit cards or items held or used for business purposes.

Accidental Damage Cover

We’ve all done it. A spill of red wine on the floor. Left our hair straighteners on the carpet. Those ‘Whoops’ moments that would ordinarily cost you a small fortune to rectify, hoping that you never make the same mistake twice. Well fear not!

Accidental Damage cover insures unexpected and unintended damage caused by something sudden and external. Accidental Damage would be required in order to claim for events that are not covered under the accidental breakage benefits. An example of this is spilling wine on a carpet, where you would only be able to make a claim if you had purchased Accidental Damage cover.

We can’t quote you right this second, but please give us a call or pop us a message and we will tell you exactly how much it would cost you to combine this very important add-on to your Contents Cover.