What is Shared Ownership?

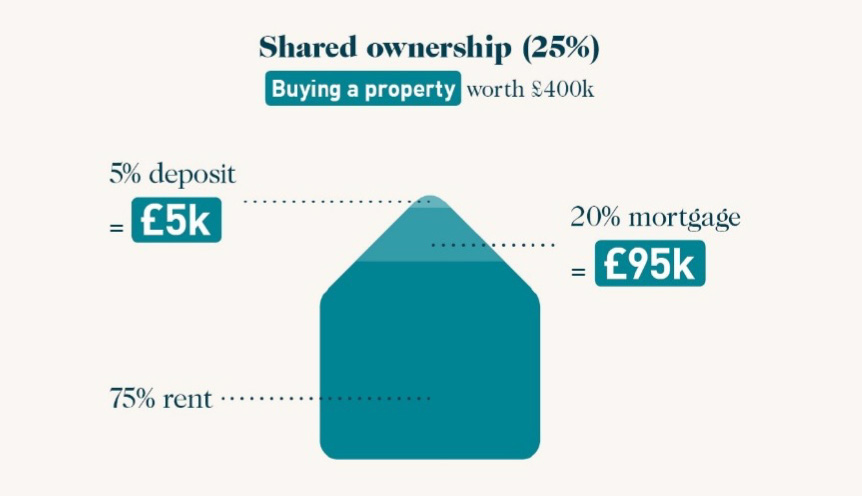

Shared Ownership is where you can purchase between 25% and 75% of a property initially, then pay a subsidised rent on the remainder which you don’t own. Shared Ownership properties are usually provided by Housing Associations and the house you are looking at would need to have been allocated for Shared Ownership in order for you to use the scheme. It’s good for those with a lower deposit as you will only need to find 10% deposit of the share that you are purchasing. As an example:

Full Market Value: £400,000

Share purchasing: £100,000

Deposit needed: £10,000

Share remaining (to pay rent on): £300,000

For a Decision In Principle, to ask any questions or to look at your affordability, please contact us and we will help you as best we can.

*This particular scheme is only available in England. Shared ownership rules differ in NI.

RTB is no longer available in Scotland or Wales